You are here: Home / News / Cosmos Health Enters $300 Million Financing Deal to Support Ethereum Treasury Plan

- Cosmos Health secures up to $300M to build Ethereum treasury, boosting shareholder value.

- Cosmos Health explores yield-generating strategies to maximize returns from Ethereum holdings.

- Ethereum treasury firms, like Cosmos Health, are more investable than U.S. spot ETH ETFs.

Cosmos Health Inc. (NASDAQ: COSM), a global healthcare company, has secured a major financing facility of up to $300 million.

The agreement, with a U.S.-based institutional investor, involves the issuance of senior secured convertible promissory notes to fund the company’s Ethereum (ETH)-based digital asset treasury reserve strategy.

The financing will support the strategic accumulation of Ethereum (ETH) to add long-term value to shareholders. Cosmos Health also plans to increase ETH-per-share to boost the value of its assets.

According to the company, at least 72.5% of the net proceeds will go towards building the company’s ETH reserve. The remaining funds will support product development, working capital and strategic growth initiatives, including the company’s planned expansion into U.S. manufacturing.

Cosmos Health’s Long-Term Growth Strategy with Ethereum

Cosmos Health intends to custody and stake Ethereum assets using BitGo Trust Company, Inc., as part of its digital asset strategy.

Furthermore, the company has plans to explore the use of blockchain in supply chain traceability, wellness incentive programs, and global consumer engagement. The company is utilizing digital assets to boost long-term growth.

In addition, the company plans to explore yield-generating strategies. The company stated that these strategies will help streamline cash flow and maximize returns from its Ethereum assets. This aims to increase the utility of the Ethereum holdings and boost long-term profitability.

CEO Greg Siokas highlighted that the financing gives shareholders direct exposure to Ethereum and provides capital for key business initiatives. According to the CEO, these efforts include accelerating product development, investing in research & development, and expanding commercial activities, with a focus on the upcoming entry into manufacturing in the U.S.

Siokas added that such a move further confirmed that the company is long-term dedicated to innovation as a way of sustaining value to its shareholders.

Also Read | Ethereum Whales Stack More ETH as Sharplink and Ether Machine lead Surge

Ethereum Treasury Firms Long-Term Market Impact

Ethereum treasury firms, like Cosmos Health, are becoming more attractive to investors. According to Geoffrey Kendrick, global head of digital assets research at Standard Chartered, these companies offer better investment opportunities than U.S. spot Ethereum ETFs. They benefit from staking rewards, ETH-per-share growth, and price appreciation.

Kendrick highlighted these firms’ favorable NAV (Net Asset Value) multiples, noting that they provide regulatory arbitrage opportunities for investors.

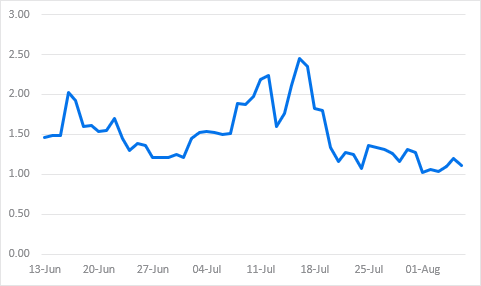

Kendrick also noted that Ethereum treasury companies have purchased 1.6% of all ETH in circulation since June, which shows their growing influence in the market. Kendrick predicts that these firms could eventually hold 10% of all ETH in circulation.

Also Read | Ethereum Consolidates, But Indicators Suggest $4,000 Breakout Possible

About Sheila

Sheila is a crypto and finance writer with over four years of experience covering blockchain, DeFi, and market trends. A graduate of the University of Nairobi in Economics and Communication, she’s known for making complex topics clear and accessible. Sheila focuses on Bitcoin, ETFs, stablecoins, digital payments, and crypto regulations. She is also a photographer and tech innovator.