Tax changes on the state and federal level this summer may compel sportsbook VIP teams to develop more incentives for high rollers.

For recreational and sharp bettors this summer, the Taxman has cometh.

The first headwinds emerged near Memorial Day when Illinois legislators passed the nation’s first-ever tax on sports wagering handle. Then, to compound matters, Republican lawmakers tossed an amendment into US President Donald Trump’s “One Big Beautiful Bill” that eliminates a percentage of write-offs that gamblers can deduct on their annual taxes.

For sports bettors in Illinois, the tax changes present a “double whammy” to their earnings potential. Several operators have responded to the new tax by announcing plans to pass the costs along to customers. At the same time, sportsbooks have been challenged by a new competitor in prediction markets, which have fewer tax burdens and less regulatory hurdles.

The tax changes raise serious questions of whether top sportsbooks will need to bolster their VIP programs to incentivise play for high rollers. Across the pond, in the UK, VIP programmes have come under pressure from regulators that have established strict standards to curb rates of compulsive gambling. All in all, the last-minute policy shifts have left C-suite officials with a busier calendar than expected this summer.

An outsized percentage

While VIP sports bettors only comprise a sliver of an operator’s total customer base, high-value customers represent an outsized portion of a book’s overall handle. Last March, Fanatics ranked second in New Jersey with a market share of 23.5%, topping gross gaming revenues from DraftKings in the month.

Multiple channel checks from Eilers & Krejcik Gaming ascribe the figures to losses from one customer described as the biggest losing customer “by a mile”.

big beautiful bill sports betting tax thoughts

the only new-ish thing i want to say is…people need to realize that even the largest losing sports bettors go into each year either thinking they’re going to win or hoping they’re going to win!!!

the ones who are aware of this…

— Dillon Borgida (@dillonborg3) July 7, 2025

There are other instances where VIP activity prospered at leading US books. Prior to its acquisition by Fanatics, PointsBet generated about 70% of its 2019 annual revenue from VIP customers, the Wall Street Journal reported. Those customers, according to the Journal, only represented roughly 0.5% of its customer base.

By joining a sportsbook’s VIP program, customers can receive certain perks such as boosted bets, free wagers and rebates. But leading books have faced increased competition from prediction markets, which can offer more favourable odds due to the exchange-wagering model.

A tax advantage?

Kalshi, a prediction market that offers event contracts on sports, saw multiple six-figure trades on the Eagles to win the Super Bowl in February. Then, in April, some high rollers flocked to the site during Masters Week. One individual purchased $665,000 in buy contracts on Collin Morikawa to not win the Green Jacket. Morikawa finished eight shots behind champion Rory McIlroy, resulting in a payout for the customer of $30,000.

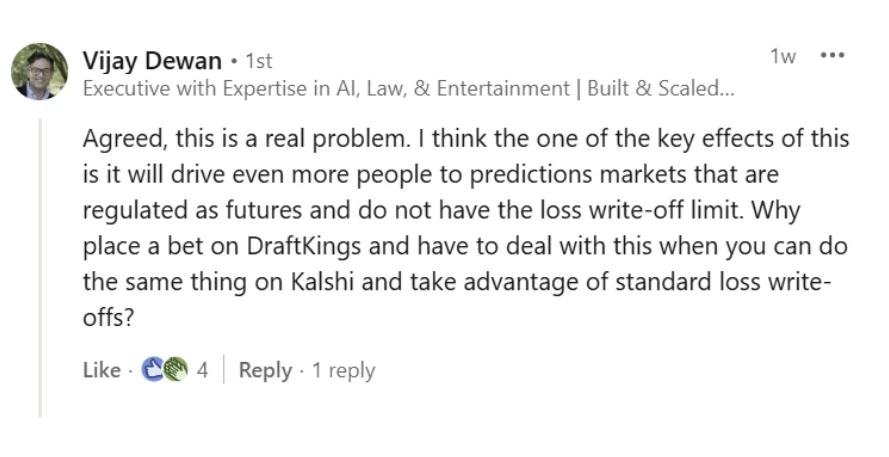

Those who trade with Kalshi can capitalise on a tax advantage under the new rules. Vijay Dewan, co-founder of Pine Sports and a former senior counsel at Deutsche Bank, discussed the implications of the federal tax policy in a LinkedIn post.

The dynamic created a lively debate at this month’s National Council of Legislators from Gaming States summer meeting in Louisville. Chad Beynon, head of US gaming research at Macquarie, served as a panelist for a session on major topics impacting the industry.

Asked if operators can offer new incentives as enticements for their VIPs, Beynon pointed to perks for high rollers in Las Vegas such as concerts at Caesars Palace and the MGM Grand.

Over the last several weeks, Beynon held a call with a top 10 sportsbook. One option under consideration is arranging meet-and-greets for VIP customers with athletes from their favorite teams.

“You can have dinner with someone on the Knicks like Josh Hart,” Beynon told iGB.

VIP restrictions in the UK

Legislators on the state and federal level are still digesting the findings of last week’s UK Gambling Commission report on VIP modifications, in order to gauge whether changes are needed in the US.

The report, issued 17 July, found that customer volume for VIP programmes has plunged at least 90% since the imposition of strict regulations in 2020 aimed at ending predatory treatment of high-risk gamblers.

The stricter regulations require operators to conduct mandatory affordability checks for any customer interested in becoming a VIP. Additionally, operators are now mandated to have updated information on a VIP customer’s sources of funds

In March, US Representative Paul Tonko of New York and Senator Richard Blumenthal of Connecticut, both Democrats, released a new version of the SAFE Bet Act, a proposed bill that seeks to create a federal framework for sports betting. The latest incarnation contains a provision that would establish certain restrictions on VIP sports bettors.

Fair Bet Act update

Under the Big Beautiful Bill, gamblers can only deduct up to 90% of their annual losses from their federal income taxes. Previously, federal law allowed gamblers to write off 100% of their losses in a given year.

Phil Galfond, a professional poker player, roundly criticised the tax policy on social media.

“A pro who earns $200k a year might have $3 million in winnings and $2.8 million in losses,” Galfond wrote. “This means earning $200k and being taxed as if they earned $480k. This new amendment to the One Big Beautiful Bill Act would end professional gambling in the US and hurt casual gamblers, too.”

US Representative Dina Titus of Nevada has introduced a bill that would restore the full deduction. The bill, the Fair Bet Act, has received bipartisan support, with sponsors from both sides of the aisle.

Americans deserve fair tax policy. That’s why I will be making my case for the FAIR BET Act this Friday in front of @WaysMeansCmte in @Vegas, the gambling capital of the country.

Both sides of the aisle support this fix, and the Ways and Means Committee is the first hurdle to… pic.twitter.com/mU7gPcYFhm

— Dina Titus (@repdinatitus) July 23, 2025

On Friday, the House Ways & Means Committee was to hold a field hearing on the federal bill in Nevada. There, Titus planned to state her case for reinstating the full deduction in 2026.